Strategies for Midsize Enterprises to Overcome Cloud Adoption Challenges

While moving to the cloud is transformative for businesses, the reality is that midsize enterprise CIOs and CDOs must consider a number of challenges associated with cloud adoption. Here are the three most pressing challenges we hear about – and how you can work to solve them.

- Leveraging existing data infrastructure investments

- Closing technical skills gap

- Cloud cost visibility and control

Recommendations

- Innovate with secure hybrid cloud solutions

- Choose managed services that align with the technical ability of your data team

- Maintain cost control with a more streamlined data stack

Innovate With Secure Hybrid Cloud Solutions

There is no denying that cloud is cheaper in the long run. The elimination of CapExcosts enables CIOs to allocate resources strategically, enhance financial predictability, and align IT spending with business goals. This shift toward OpEx-based models is integral to modernizing IT operations and supporting organizational growth and agility in today’s digital economy.

But migrating all workloads to the cloud in a single step carries inherent risks including potential disruptions. Moreover, companies with strict data sovereignty requirements or regulatory obligations may need to retain certain data on-premises due to legal, security, or privacy considerations. Hybrid cloud mitigates these risks by enabling companies to migrate gradually, validate deployments, and address issues iteratively, without impacting critical business operations. It offers a pragmatic approach for midsize enterprises seeking to migrate to the cloud while leveraging their existing data infrastructure investments.

How Actian Hybrid Data Integration Can Help

The Actian Data Platform combines the benefits of on-premises infrastructure with the scalability and elasticity of the cloud for analytic workloads. Facilitating seamless integration between on-premises data sources and the cloud data warehouse, the platform enables companies to build hybrid cloud data pipelines that span both environments. This integration simplifies data movement, storage and analysis, enabling organizations to extend the lifespan of existing assets and deliver a cohesive, unified and resilient data infrastructure. To learn more read the ebook 8 Key Reasons to Consider a Hybrid Data Integration Solution

Choose Managed Services That Align With the Technical Ability of Your Data Team

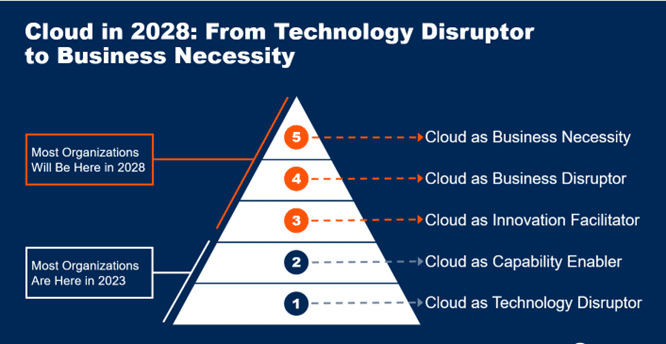

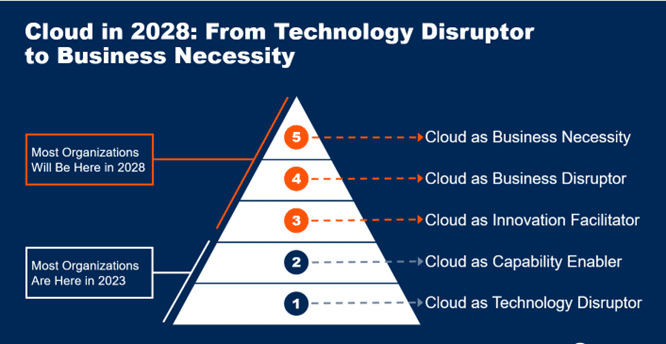

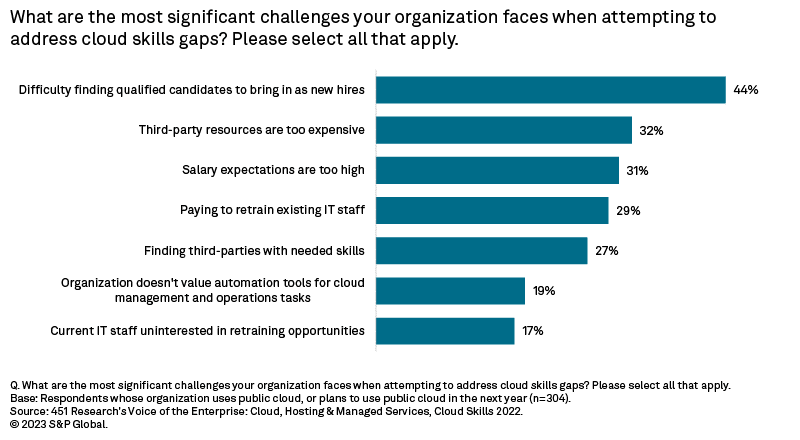

Cloud brings an array of new opportunities to the table, but the cloud skills gap remains a problem. High demand means there’s fierce market competition for skilled technical workers. Midsize enterprises across industries and geos are struggling to hire and retain top talent in the areas of cloud architecture, operations, security, and governance, which in turn severely delays their cloud adoption, migration, and maturity. This carries the potential greater risk of falling behind competitors.

Bridging this skills gap requires strategic investments in HR and Learning and Development (L&D), but the long-term solution has to go simply beyond upskilling employees. One such answer is managed services that are typically low- or no-code, thus enabling even non-IT users to automate key BI, reporting, and analytic workloads with proper oversight and accountability. Managed solutions are typically designed to handle large volumes of data and scale seamlessly as data volumes grow—perfect for midsize enterprises. They often leverage distributed processing frameworks and cloud infrastructure to ensure high performance and reliability, even with complex data pipelines.

Actian’s Low-Code Solutions

The Actian Data Platform was built for collaboration and governance midsize enterprises demand. The platform comes with more than 200 fully managed pre-built connectors to popular data sources such as databases, cloud storage, APIs, and applications. These connectors eliminate the need for manual coding to interact with different data systems, speeding up the integration process and reducing the likelihood of errors. The platform also includes built-in tools for data transformation, cleansing, and enrichment. Citizen integrators and business analysts can apply various transformations to the data as it flows through the pipeline, such as filtering, aggregating and cleansing, ensuring data quality and reliability—all without code.

Maintain Cost Control with a More Streamlined Data Stack

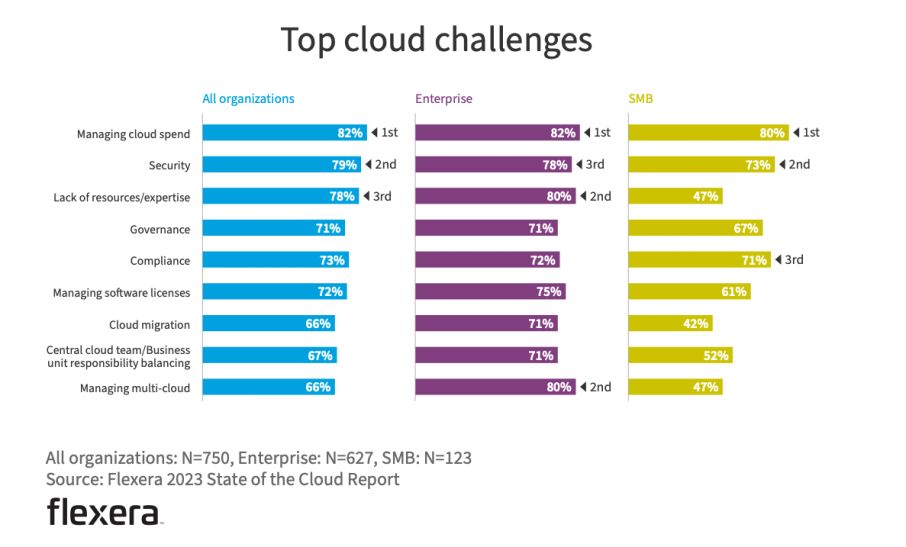

Midsize enterprises are rethinking their data landscape to reduce cloud modernization complexity and drive clear accountability for costs across their technology stack. This complexity arises due to various factors, including the need to refactor legacy applications, integrate with existing on-premises systems, manage hybrid cloud environments, address security and compliance requirements, and ensure minimal disruption to business operations.

Point solutions, while helpful for specific problems, can lead to increased operational overhead, reduced data quality, and potential points of failure, increasing the risk of data breaches and regulatory violations. Although the cost of entry is low, the ongoing support, maintenance, and interoperability cost of these solutions are almost always high.

A successful journey to cloud requires organizations to adopt a more holistic approach to data management, with a focus on leveraging data across the entire organization’s ecosystem. Data platforms can simplify data infrastructure, thus enabling organizations to migrate and modernize their data systems faster and more effectively in cloud-native environments all while reducing licensing costs and streamlining maintenance and support.

How Actian’s Unified Platform Can Help

The Actian Data Platform can unlock the full potential of the cloud and offers several advantages over multiple point solutions with its centralized and unified environment for managing all aspects of the data journey from collection through to analysis. The platform reduces the learning curve for users, enabling them to derive greater value from their data assets while reducing complexity, improving governance, and driving efficiency and cost savings.

Getting Started

The best way for data teams to get started is with a free trial of the Actian Data Platform. From there, you can load your own data and explore what’s possible within the platform. Alternatively, book a demo to see how Actian can accelerate your journey to the cloud in a governed, scalable, and price-performant way.

The post Strategies for Midsize Enterprises to Overcome Cloud Adoption Challenges appeared first on Actian.

Read More

Author: Dee Radh